Although consumers' sense of security plays a role in the choice between card and cash, this also applies to the retailers themselves, of course. The less money there is in the till, the less attractive your shop becomes for robbers. So we are witnessing a growth in shops where you can pay only by card. For the most part, these are still independent shops, but it is expected that some chains will also test this out now that the ratio of card to cash is getting bigger (and consumers are therefore less likely to want both forms of payment).

Cards and returns

Yet having less cash in the till is inconvenient when dealing with returns. Consumers who return an item often expect cash back at the checkout of a physical store. Because tills are emptying, this sort of return is becoming more difficult. The cash in the till is simply running out, and larger returns are almost impossible. This applies very much to sectors where many articles are ordered online but are also returned. The fashion industry is a striking example of this. Encouraging click & collect to cut down on delivery costs also means that consumers will bring their returns from the online order (whether or not via click & collect) to the store. There may be days when more is returned than is sold in the store, which is a challenge for the cash register.

One obvious solution is debit card chargeback. The retailer can then immediately use the payment terminal to pay back the value of the product to the consumer's account and this will further interrupt the flow of cash. This is a great system that has not yet been widely adopted by retail. At the end of 2016, only 22% of stores offered debit card chargeback. However, we expect that this will take flight in the next two years. It will also be driven by consumers who are increasingly less fond of carrying cash in their wallets.

The future

Now that the consumer has embraced other forms of payment, developments in new ways of payment will start to take off. While it took consumers about 20 years to accept debit card payments, contactless payment has conquered the market in just three years. So it will be a small step to the next way of paying.

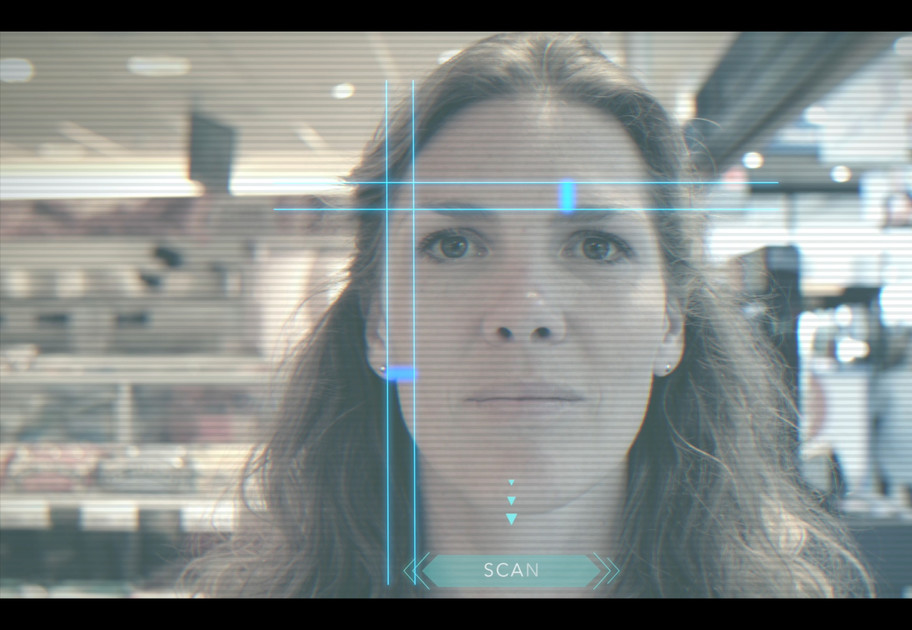

There are great opportunities to be seen in paying directly with your mobile phone. Most people already have a banking app on their smartphone and that offers plenty of options, of course. The NFC technology built into many telephones can also easily replace the debit card. The advantage of paying with your mobile is that payment will be even easier, and more secure, because your fingerprint (also used to enable the phone) will be the unique code for paying. But more is possible. Your phone can also be your handscanner when you do your shopping. When you have finished shopping, all you have to do is verify the purchase and you can continue.

Amazon has made things even more interesting with Amazon Go. In Amazon Go, accurate NFC technology in your phone checks what is in your shopping cart and deducts your bill directly from your Amazon account as you leave the shop. You can then pay this later in the month (or immediately, depending on your settings). This means that major retailers will start to profile themselves more as financial institutions. And this will provide them with very valuable data. Of course, consumers will embrace this as long as there is more ease of payment in return!

.png?width=641&height=253&name=Kega%20logo%20(white%20bg).png)